Oil Prices and the Recreational Real Estate Market

The myth of oil prices hurting Fernie real estate

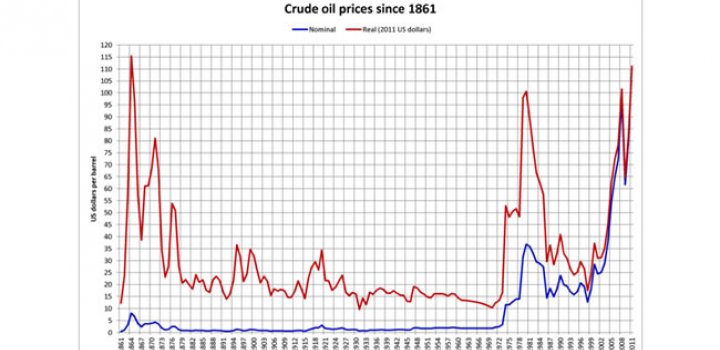

Low oil prices do not hurt the Fernie market, it is a myth, it helps the Fernie market. During the robust and thriving Fernie real estate development and construction from 1995 to 2005, oil prices were in the vicinity of $30/bbl. and Fernie construction boomed.

Low oil prices means a lower Canadian dollar, a strong UK sterling, and a strong US dollar. As in the 1995 to 2005 years, real estate is an inverse graph to the low oil prices. With the low $C there are more buyers visiting Fernie and purchasing.

- Americans and UK visitors will visit, purchase and use their properties. A 35 percent discount for Americans and a 50 percent discount for UK. The same as in the 1995 to 2005 years.

- Canadians have started selling their AZ, CA or MT properties and gaining a 40 percent fx gain on their $C. Once again, the families will buy in Fernie and choose Fernie or Invermere over an American seasonal property.

- Amenity migration for life style will be very strong as it was last year. Kelowna had a 10 percent growth in real estate sales year-over-year in 2015, people choosing to live in Kelowna. View the report from the Okanagan Mainline Real Estate Board.

Individuals will choose Fernie and the Kootenays for mountain living.